When it comes to desirable and popular places to live, affordable housing for all is a myth. It is an emotional political talking point designed to get votes while tossing out the most basic law of economics: the law of supply and demand. When politicians talk about affordable housing initiatives, they are usually referring to subsidized housing or housing projects. This form of government market manipulation overrides the free-market principle of supply and demand. Subsidized housing projects have failed miserably in cities across the country for decades. The housing units themselves are notorious for being poorly maintained and having elevated crime rates, and now these types of projects are being implemented in Ottawa County.

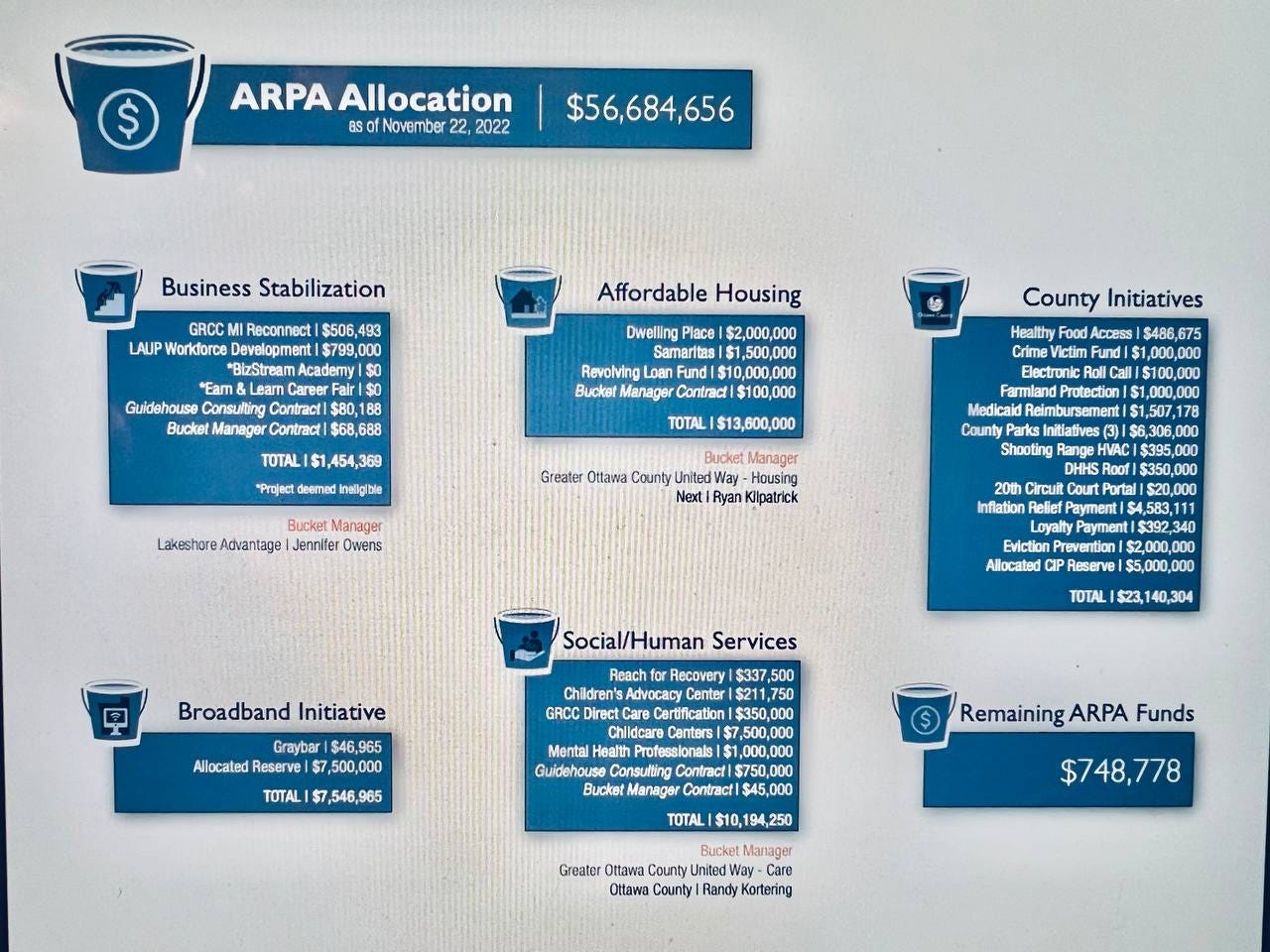

In July 2020, Ottawa County became qualified as a Public Housing Authority. This gave the county the power to acquire, construct, operate, lease, rehabilitate and sell property. Then in November 2022, the previous Ottawa County board of commissioners approved $13.6 million in American Rescue Plan Act (ARPA) funding for affordable housing projects.

In January 2024, construction began on a 53-unit low-income housing development in Spring Lake by the nonprofit Samaritas (who received $1.5 million of county ARPA funding) in conjunction with the Pinnacle Construction Group. Future residents will have access to a bike share, electric vehicle charging station, and outdoor community space. During the July 2, 2024, Ottawa County Finance committee meeting (1:11:40), commissioners discussed anticipated apartment rental rates for the new Spring Lake project as well as a housing project in Hudsonville. The one-bedroom apartments, which range in size from 620-780 square feet are anticipated to rent for $1500-$1650. The two-bedroom, 830-1050 square feet apartments are projected to rent for $1800-$1975.

Commissioner Rebekah Curran commented, “Maybe the statement ‘affordable housing’ might be subjective, because I don’t personally consider these rents affordable; especially for the size of these apartments.”

Expanding on Commissioner Curran’s point, according to the article, How Much House Can I Afford Without Feeling Strapped Every Month?, “a person’s home payment should be no more that 30% of their gross income each month,” and financial expert Dave Ramsey believes 25% is a better percentage. Therefore, $1,500/month is the maximum housing payment that should be undertaken with an annual income of $60,000 equivalent to a monthly income of $5,000. ($5,000 x .30) = $1,500. This roughly equates to a wage of $28/hour; quite a stretch for a low-income earner.

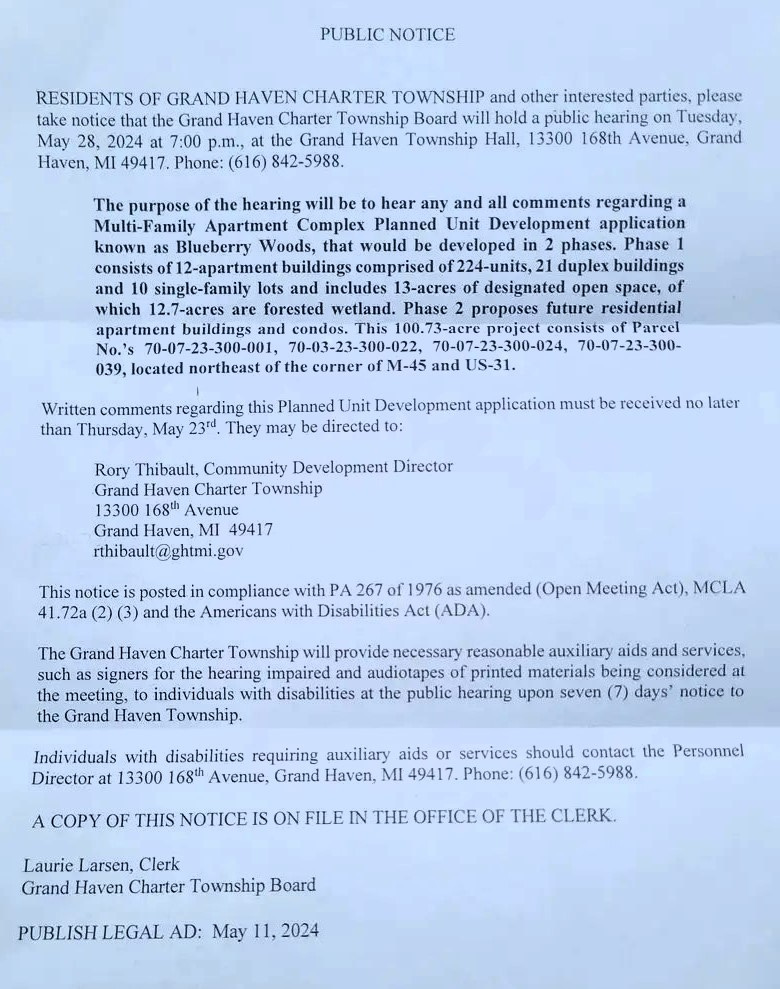

Did you know plans are in the works to develop 100 acres of property on US 31 just north of M-45? The developer wants to begin by constructing 12 apartment buildings, 21 duplexes, and 10 single-family homes. At least 12 acres are on forested wetlands. While Ottawa County is one of the fastest growing counties by population, it is a leader for rapidly decreasing areas of wetlands. The development will be called Blueberry Woods, I suppose to commemorate that there will be no more blueberries or woods once the construction is completed.

Progressive politicians with master’s degrees in public administration and political science, who believe in implementing subsidized housing projects make statements such as, “I want my kids to be able to buy homes where we raised them and housing prices are ridiculous. There needs to be options available for people to have affordable homes. Our home has doubled in value in ten years, which is crazy. If we wanted to buy our home now, we couldn’t afford it.”

These statements are effective because they resonate with most people. The problem is housing is largely unaffordable due to the basic economic principle of supply and demand coupled with government policies that have resulted in excessive taxation of the citizenry. Additionally, investment limited liability corporations (LLCs) are now purchasing single-family homes.

Housing prices are unaffordable in Ottawa County simply because the demand to live here is high. Additionally, many people own second homes in our county, thereby reducing the available pool of land/housing from being utilized by year-round residents. Traditionally, demand for housing rises when the number of available jobs in an area increase, but today, working remotely has allowed people to live anywhere they wish. Low crime, available recreation, weather, etc., play a role in this very individualized decision. To many, Ottawa County is desirable, which begs the question, what would make it undesirable? Perhaps being so densely populated that it would take one hour to drive 3 miles across town? Perhaps non-family friendly ordinances that result in public displays of drunkenness, a hypersexualized environment, or the constant smell of marijuana in public spaces? Perhaps a polluted lake that can no longer be used for recreation? As the world ebbs and flows, situations change and when demand no longer outpaces supply, housing prices will stabilize and become more affordable.

Until Ottawa County becomes an undesirable place to live, people from out of town will continue to come in, rent apartments and purchase homes, leading to higher housing prices. Subsidized housing does not solve the problem. A better solution is to decrease regulation and lower taxes so people can afford to live. Robert F. Kennedy’s solution involves changing the tax code, and 3% interest mortgages available to first-time home buyers. While I can see potential problems with his mortgage plan, changing the tax code so that it is less desirable for LLCs to purchase homes appears to be one step in the right direction.

Continuing on our current trajectory could result in the whole county being paved over. Developers are responding to the demand and bringing density to rural America, slowly wiping out the natural beauty all around us. I want housing to be affordable too, but not at the expense of quality of life. The progressive solution has not worked in other places so why are we bringing it here?