Article updated February 25, 2025

To be clear- The organizations mentioned in this article have not been accused of any financial impropriety associated with USAID, but it does show how USAID takes advantage of legitimate funding networks.

The Department of Government Efficiency (DOGE) team, led by Elon Musk, is making shocking discoveries as it investigates government fraud, waste, and abuse. Due to this much-needed effort, the United States Agency for International Development (USAID) has become a common word in many American households as the depths of its wasteful, and often un-American, spending are exposed. It has been reported that over $600 million of taxpayer dollars was used to fund illegal migration through USAID every few months in recent years. USAID funding has been linked to color revolutions across the world, contributing to the BLM riots of 2020, and to supporting media used to silence the voices of the people while providing them with propaganda.

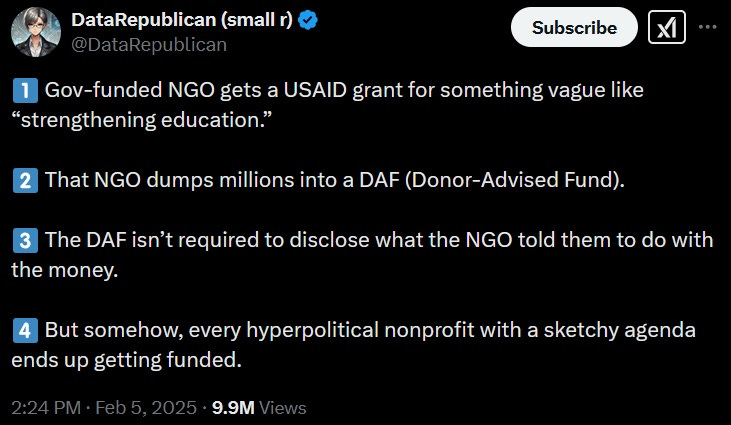

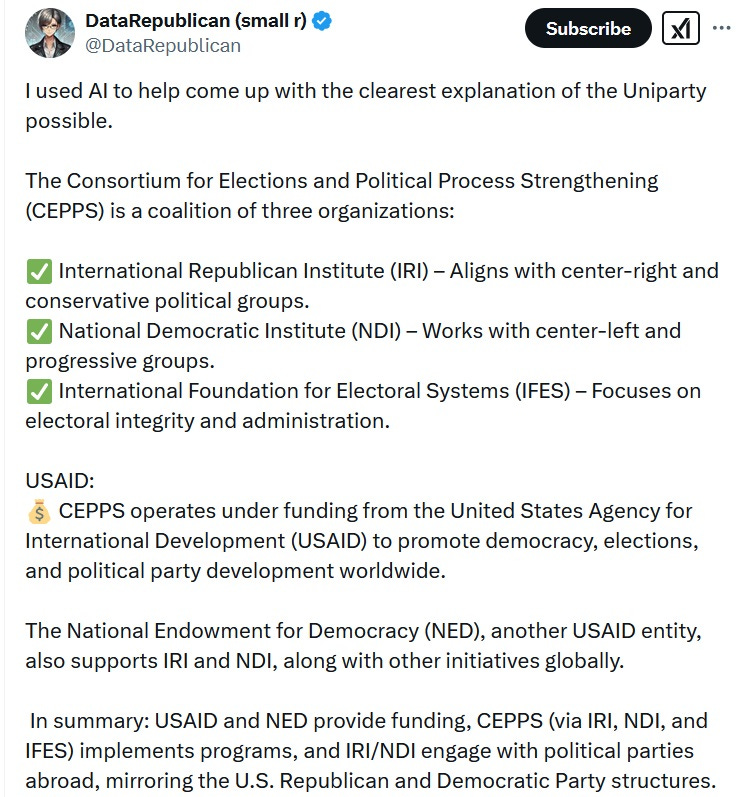

Understanding how taxpayer dollars are spent is difficult as they flow from our state and federal governments to numerous non-government organizations (NGOs) and non-profits which have fewer reporting requirements. DataRepublican (small r) on X explained that “the system is designed with multiple layers of plausible deniability. If people object to being linked to USAID funding indirectly, they should push for transparency and the removal of these layers – along with ending the NGO system that enables it.” DataRepublican has created a website that accesses information from USASpending.gov, the official open data source of federal spending information, making it easier to track federal funding that originated with USAID.

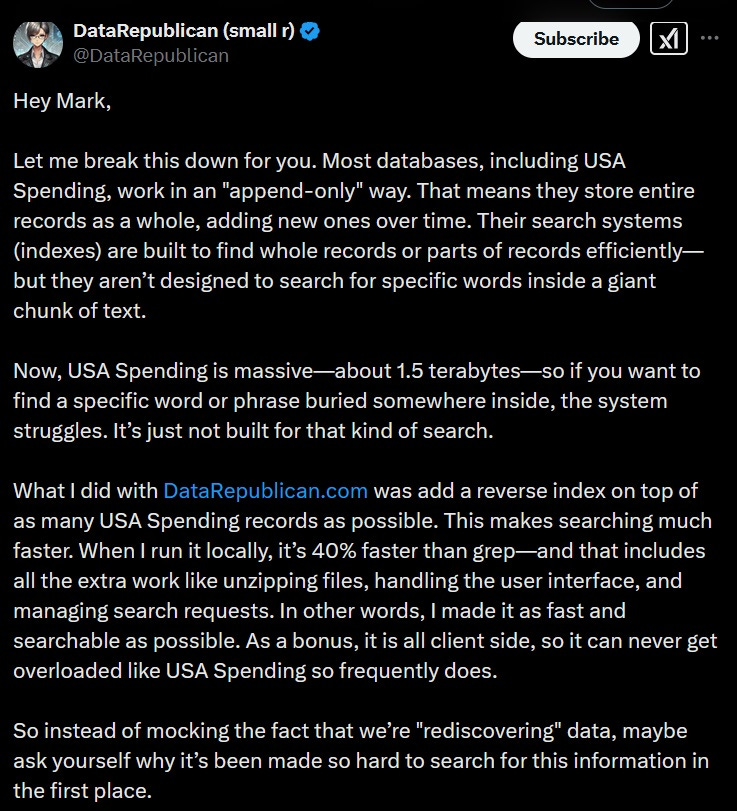

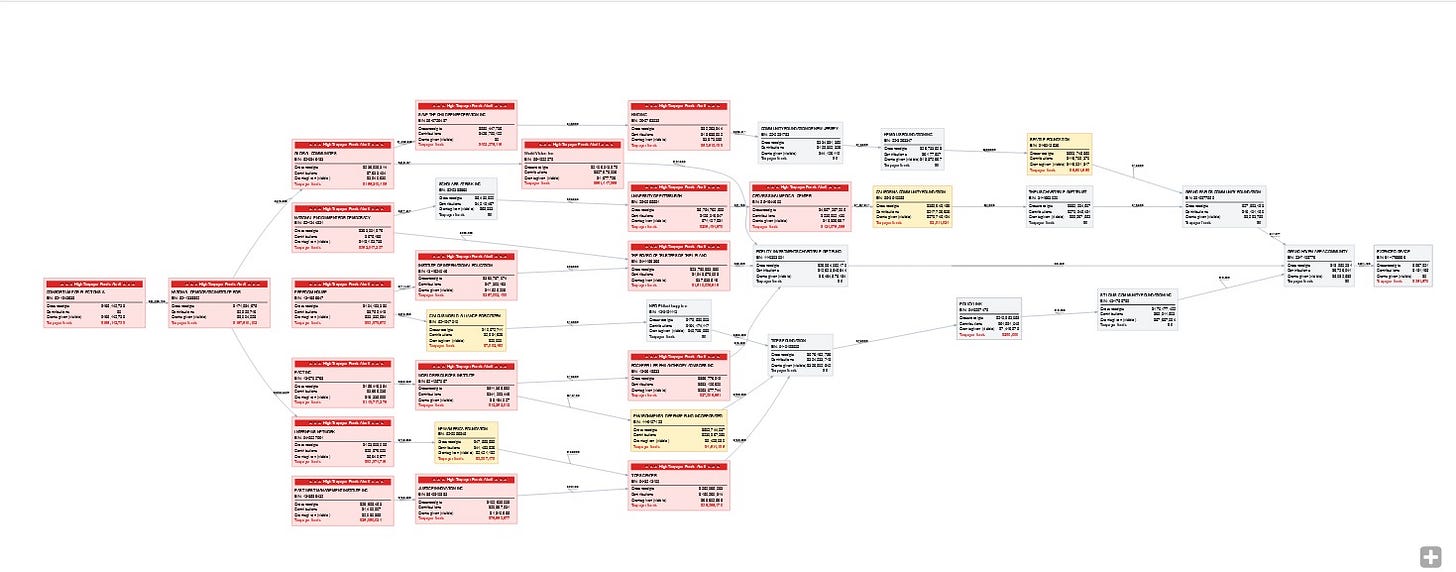

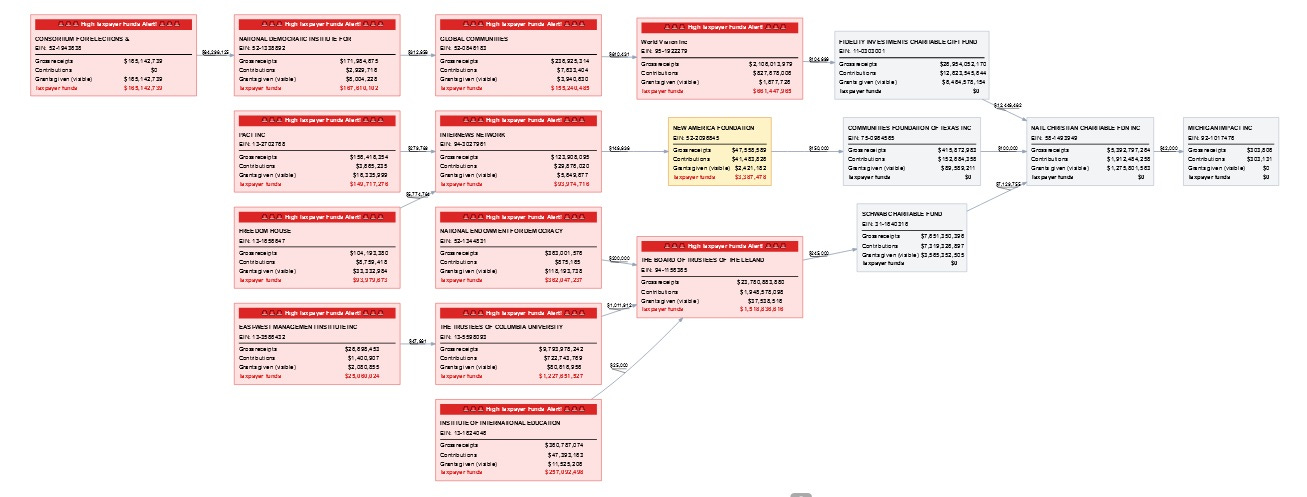

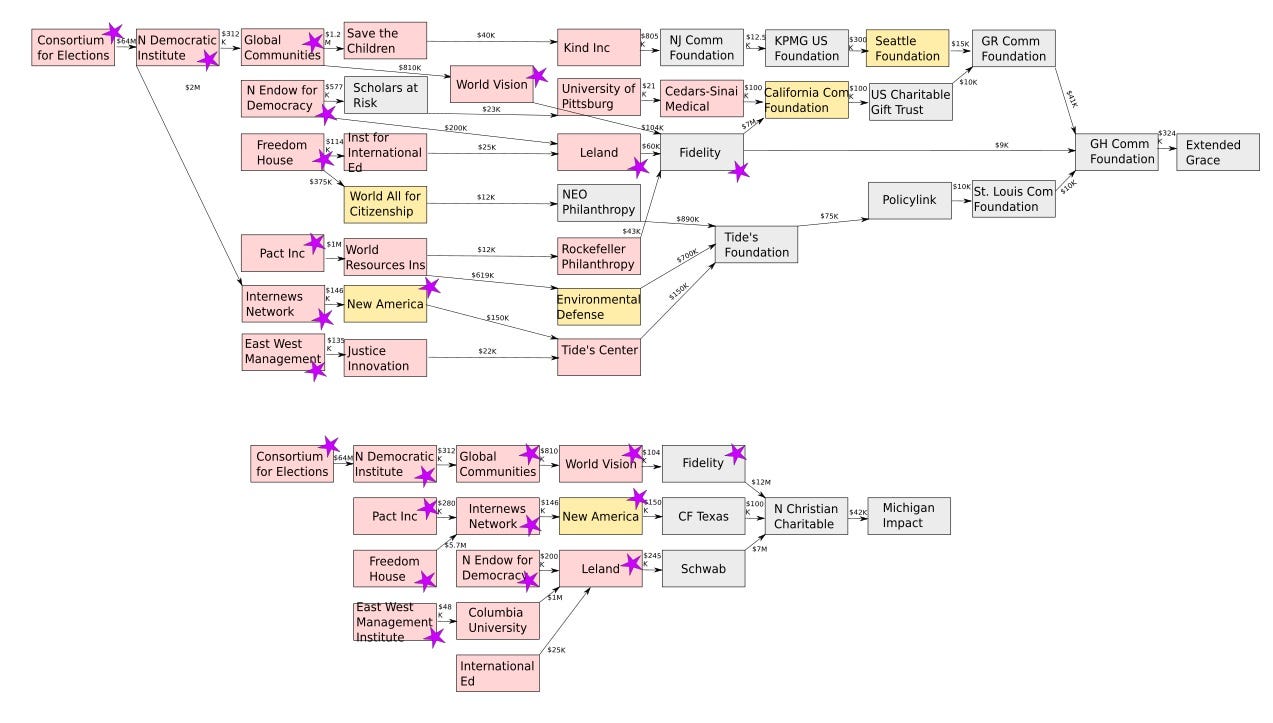

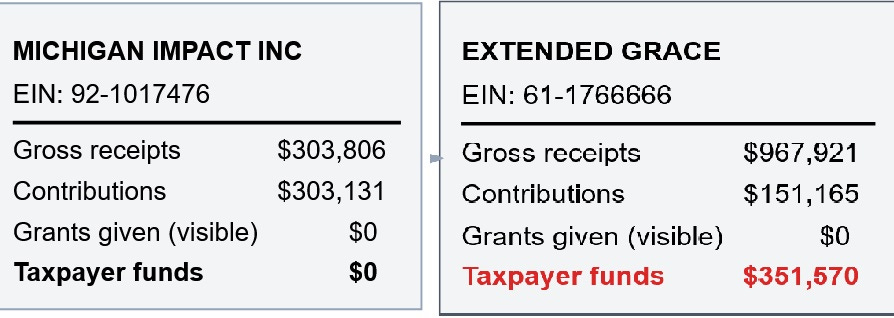

The following, two, big-picture charts show how American tax dollars originated at USAID and flowed through a network of organizations. Along the way, taxpayer funding is mixed with private donations which then ends at local nonprofit entities. The chart on top ends with Extended Grace on the right which is the tax-filing name of the Momentum Center. The chart on the bottom ends with Michigan Impact, a nonprofit organization operating at the state level, affiliated with Ottawa Impact. The pink boxes signify organizations that receive a high amount of taxpayer funding. Grey boxes indicate that none of the money received through the mapped channel is considered taxpayer funding despite the fact that a lot of it could have originated with taxpayers. However, it is possible that entities with grey boxes received direct taxpayer funding that came from other channels such as grants.

Click the links to zoom in on the charts:

Data from the above charts has been re-rendered in the charts below to make them easier to read from an overall perspective. The purple stars denote entities included on both flow charts.

It is difficult to find two more polar opposite organizations than the Momentum Center and Michigan Impact. “Michigan Impact creates lasting cultural change. Their projects are built on timeless principles of truth and human flourishing.” Their affiliate, Ottawa Impact, supports political candidates that follow the principles of the Constitution. The Momentum Center claims to be a non-political, social recreation organization that supports individuals with mental health challenges, but has engaged in get-out-the-vote efforts, COVID-19 vaccination events, and numerous events supporting social justice and diversity, equity, and inclusion initiatives.

Nonetheless, both entities are part of the same greater funding network. In both cases paths exist for money to flow from the Consortium for Elections, to the National Democratic Institute, to Global Communities, to World Vision Inc., to the Fidelity Investments Charitable Gifts Fund. From there, Fidelity can direct funds to the Grand Haven Area Community Foundation which gives to the Momentum Center. Fidelity can also direct funds to the National Christian Charitable Foundation Inc, a Donor Advised Fund (DAF) which is used by private donors to direct money to nonprofits such as Michigan Impact. Without viewing the books of nonprofit entities, it is impossible to know where funds originated (DAF, or taxpayer, or other).

At any point along the way, taxpayer funding can be mixed with private donations. When an entity that received taxpayer funding sends that money out, it is no longer considered taxpayer funding. The network of funding connected to the Momentum Center includes the Community Foundation of New Jersey, the Seattle Foundation, the California Community Foundation, the Saint Louis Community Foundation, the Grand Rapids Area Community Foundation, and Tide’s Foundation. The funding network that is connected to Michigan Impact includes the Community Foundation of Texas.

Who would have thought that taxpayer money could pass through so many entities and that community foundations would give to each other? Why would community foundations in St. Louis, Seattle, New Jersey, and California want their money to end up at the Grand Haven Area Community Foundation? DataRepublican explained how the system works.

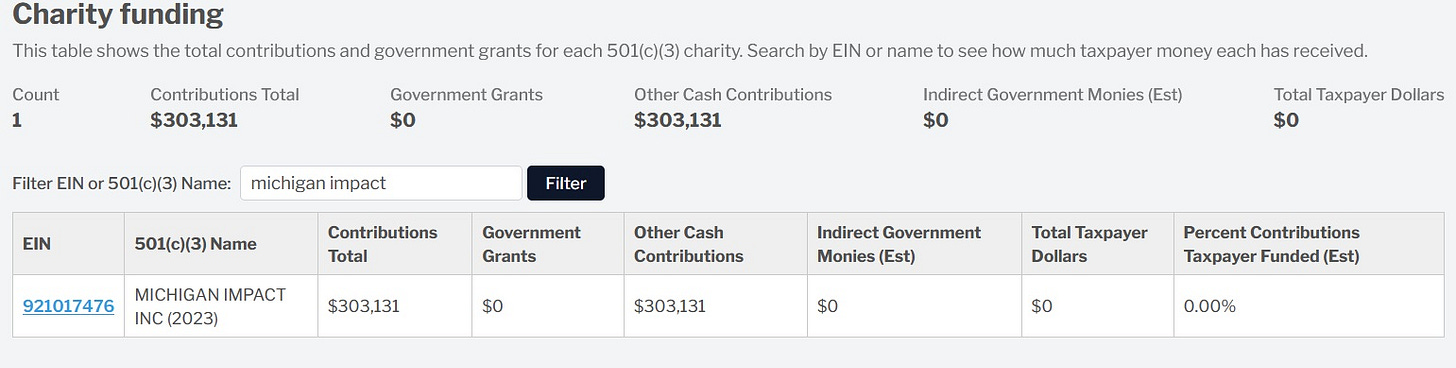

While the above data indicates neither organization received direct taxpayer funding that originated with USAID, according to the DataRepublican Michigan Impact charity funding table, 0% of the funding received by Michigan Impact originated as taxpayer funding, but 69.9% of the funding received by the Momentum Center originated as taxpayer funding. This is because the Momentum Center received a direct government grant.

While other Ottawa County nonprofits such as the Greater Ottawa County United Way, Opportunity Thrive, and Community Action House appear on searches within the DataRepublican website, many others such as Grady’s Classroom, Arbor Circle, Community Spoke, Lakeshore Nonprofit Alliance, and Thrive Ottawa do not. This indicates that their funding networks are not connected to USAID, but does not eliminate the possibility that they received funding that originated with the Department of Education, the Department of Health and Human Services, or another government entity.

Looking only at USAID shows a single government entity could be used to fund nonprofits whose foundational missions oppose each other. It appears one goal of this funding is to keep the people divided. Perhaps another goal is to support people financially, so they do not question government spending. This concept is known as “the Uniparty” and again DataRepublican explains.

Besides creating division among the citizenry, furthering woke agendas, and financially supporting entities with opposing political beliefs, it is not unreasonable to question whether significant portions of this money are being used to pay people off. This leads to the question: Who are the nonprofits paying for services rendered?

The entrenched Uniparty has been revealed. Numerous politicians are losing their minds over the exposure of their favorite piggybank, USAID. More information is likely to be forthcoming. While accepting money from donors is not a crime, “The true crime is the laundering of this money and using it to shape the world we never wanted.” ~Dave at X22