Michigan special elections will take place on May 6. GHAPS, along with many Ottawa County schools districts, are again asking for funding through bond and operating millage proposals which, if passed, will impact your finances. One big request being made on Tuesday comes from the Ottawa Area Intermediate School District (OAISD). They are requesting voters pass a special education millage that will be active until 2044 and cost voters over $4.5 million in 2025 alone.

School district employees are sure to turnout and vote in favor of these proposals as some of their livelihoods are directly connected to the election outcomes. This is despite the declining quality of the service provided by the public school district bureaucracy. Make all the jokes about the rural south you want, but Mississippi just passed Michigan in fourth grade literacy. Michigan is a bottom feeder in the national rankings, besting only six other states. My questions are, will average taxpayers also show up to vote, and will they be in favor of, or against the plethora of ballot proposals that manifest as additional taxes?

In the Grand Haven Area Public School (GHAPS) district alone, there were many reasons voters twice recently rejected bond proposals. When GHAPS proposed a bond of $155 million for a new school and athletic facility, voters were concerned the construction plans lacked transparency and doubted that the administration could be good stewards of taxpayer money. Then, even more community members lost confidence in district administration when they made a rush decision to convert Mary A. White Elementary school into a preschool without a detailed plan or financial analysis. Voters tend to be placated with statements like, “we must fund schools” or “the children will suffer.” But does the money actually make it to the children? In Grand Haven, while enrollment declined, expenditures went up.

So how is school district money actually spent? Is there a better way to allocate resources that will actually improve education?

Perhaps the most egregious GHAPS expenditure is a combined $213,616 on advertising and bond-planning. That is over $200,000 that could have gone to actual education, but was wasted in an attempt to persuade the public to provide the district with additional funding.

Board Policy 1130 addresses conflicts of interest - “No employee, officer, agent, or Board member shall engage in or have a financial or other interest, directly or indirectly, in any activity that conflicts or raises a reasonable question of conflict with the employee's, officer's, agent's, or Board member's duties and responsibilities in the school system.” Despite this policy, there are potential concerns regarding conflicts of interest with at least two GHAPS board members.

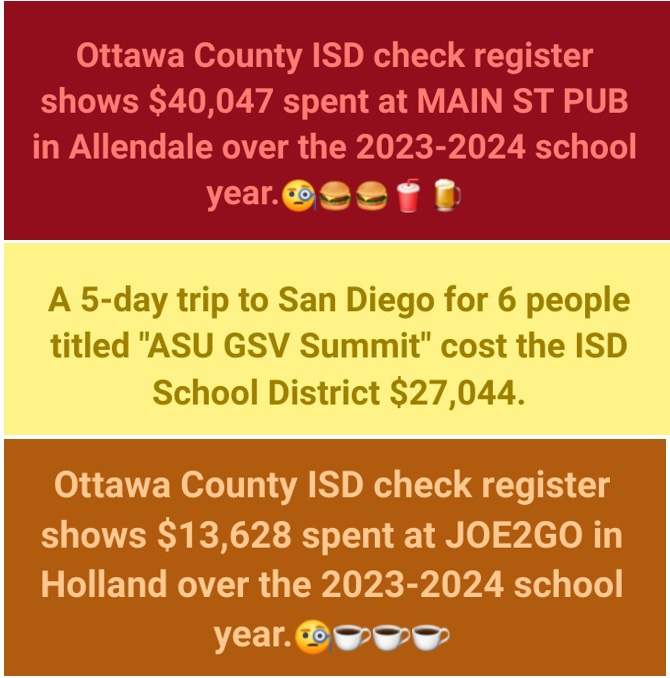

These concerning spending habits are not unique to GHAPS. The OAISD spent over $40,000 at a pub, $13,000 at a coffee shop, and $27,000 on a trip across the country.

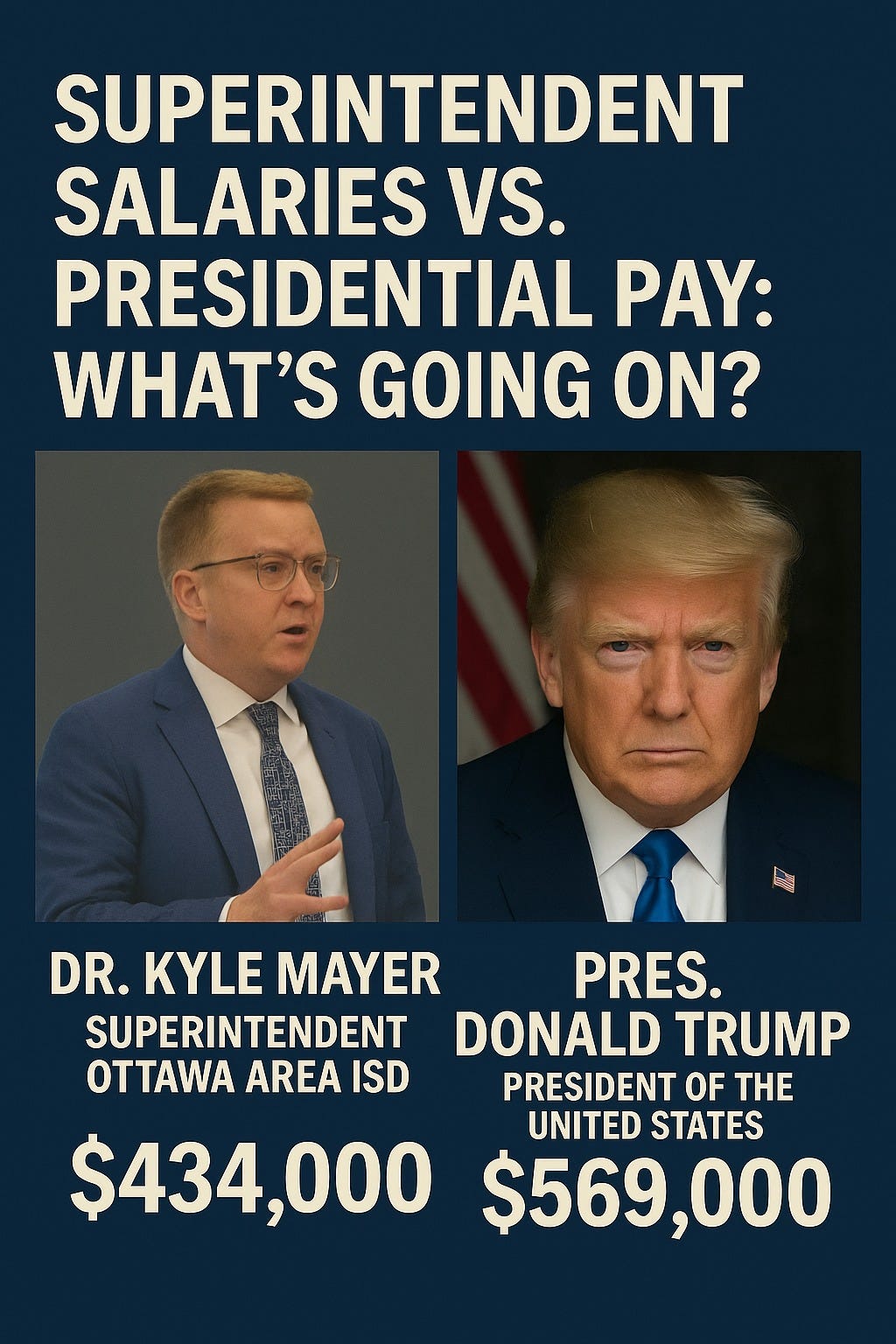

Additionally, over sixty OAISD administrators earn over $160,000, and the OAISD superintendent’s total compensation is approximately $434,000. I will guess that most of the public does not even know that there is a position of OAISD superintendent, and that he gets paid eight times the median household income in the county.

The OAISD is asking not for only a continuation of the current millage, but for a 20-year increase of $0.5 for every $1000 on taxable valuation. This would amount to an increase of $75 per year for a house valued at $300,000, on the approximately $200 already allocated to the OAISD. GHAPS is asking for 18 mills on each $1000 of non-primary residences. This amounts to $2,700 for a property valued at $300,000, but since these are non-primary residences, they are more palatable to the public as the tax is primarily paid for by second homeowners and businesses. But the public should not be fooled. This high operating millage does have a ripple effect. Renters for example, wondering why rent is unaffordable, could look at this millage as a contributing factor.

School district bonds and millages tend to pass easily as they are requested during elections that have lower voter turnout, and because residents know that in general good quality schools correlate to higher property values. But for people on a fixed income, being taxed out of their home is a real concern, and increasing taxes on part of the population does have a ripple effect. How much tax is acceptable? When is enough, enough? Before voting this Tuesday, ask yourself if you think we should continue blindly funding school districts who appear to have lost sight of their primary mission. Ask yourself what are the building blocks of a quality education? Are competent teachers with pencils, paper, and books or beautiful buildings with state-of-the-art technology the key? Are the taxpayers who fund, and the students who attend these establishments, getting the return on investment they deserve, or could voters demand improvement by rejecting current requests and demanding administrators re-evaluate their priorities and perhaps tighten their financial belts?